Is Gas Tax Money Going Toeards Transit Projects

Transportation

Frequently Asked Questions

- Transit

- How Is Transit Funded?

- How Is Funding for Transit Spent?

- Transportation Taxes and Fees

- What Taxes Apply to Gasoline in California?

- How Does the Land Spend Gasoline Revenue enhancement Revenues?

- How Take Gasoline Taxes Inverse Over Time?

Transit

How Is Transit Funded?

Many Agencies Provide a Diversity of Transit Services. For the purposes of this page, transit services includes coach, rail, paratransit, vanpool, and ferries. (In addition to transit, there are other mass transportation services, such as intercity rail and commercial aviation.) Transit services are provided by over 200 operators in California, including cities, counties, contained special districts, transportation planning agencies, private nonprofit organizations, universities, and tribes.

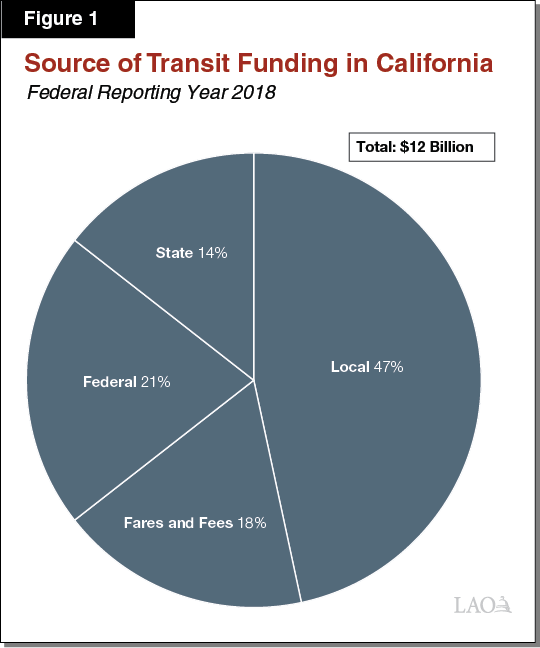

Transit Funding Comes From Variety of Sources. Transit operators that receive federal funds are required to regularly report their financial information to the federal authorities, which publishes a national study each federal reporting year (FRY). In total, transit services in California were funded at $12 billion in FRY 2018. Every bit shown in Figure 1, this funding came from various sources, including local, federal, and country taxes, as well every bit from passenger fares and fees.

Local Regime Contributed Well-nigh One-half of Transit Funding. Local funds are generated in multiple ways, just 79 percent of these funds came from sales tax revenues. Local sales tax revenues include both counties' share of the Local Transportation Fund (LTF), likewise as local sales revenue enhancement measures. Through LTF, counties receive revenues from a one-quarter per centum sales tax practical to all goods statewide. All counties receive LTF revenues, which must exist used for transportation purposes, including transit services. In addition, in 25 "self-assist" counties, voters have passed a i-one-half percent sales tax for transportation, a portion of which goes towards transit.

State and Federal Funds Make Up Roughly One-Tertiary of Funding. Land and federal funds come from multiple sources, but the majority comes from state and federal taxes on gasoline and diesel. Federal funds are largely disbursed through the Fixing America's Surface Transportation (FAST) Act, which is funded by the federal tax on gasoline. At that place are 33 programs under the FAST Act with five programs making up 89 percentage of federal funds for transit in California: (ane) the Urbanized Area Formula Plan, (2) the Rural Expanse Formula Program, (3) the State of Good Repair Program, (iv) the Bus and Bus Facilities Grant Program, and (5) the Uppercase Investment Grants Program. Nearly of these funds are disbursed on a formula basis.

Land Transit Assistance, which is funded through the state sales tax on diesel, makes up the largest share of state funds for transit, distributing almost $700 million to planning organizations and operators on a formula basis in 2017‑xviii. Other land programs that specifically fund transit include the Low Carbon Transit Operations Programme (LCTOP) and the State of Practiced Repair Program (SGR), which are disbursed on a formula footing, besides equally the Transit and Intercity Rail Capital letter Programme (TIRCP), a competitive fund. In 2017‑18, LCTOP was funded at $71 million, SGR at $105 million, and TIRCP at $209 million. Transit may also receive funding through other state programs—such as the Solutions for Congested Corridors and the Country Transportation Improvement Programme—that likewise support projects to expand or repair highways and local streets and roads.

1-5th of Funding Comes From Fares and Fees. Users of transit services pay providers fares to employ their services and operators generate additional revenues from users through auxiliary fees, such as for park and ride services, concessions, and advert. Still, these fares and fees simply make up a modest share of total revenues for transit.

(Last updated: January 2020)

How Is Funding for Transit Spent?

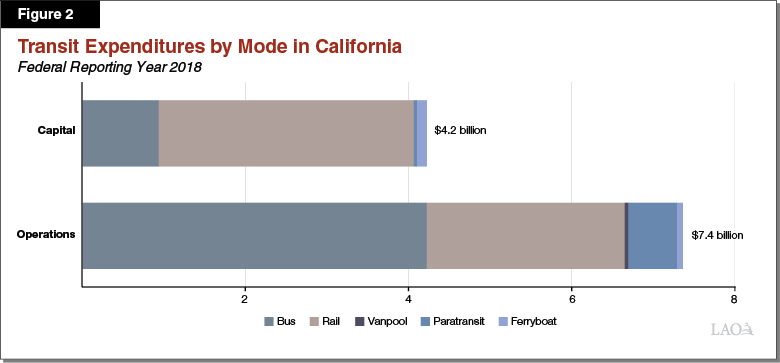

$12 Billion Spent on Local Transit in California. Expenditures for transit by and large are categorized as operations or capital. Operations include compensation for transit drivers and other staff, as well equally vehicle and facilities maintenance. Capital includes the costs to purchase equipment—such as new buses and rail cars—and construct facilities, such as stations and rails systems. As shown in Figure 2, 64 percentage of transit expenditures in California were for operations in FRY 2018.

More Than One-half of Operating Expenses Were Spent on Buses. Buses are the about popular fashion of transit. In FRY 2018, 63 pct of all passenger trips on transit in California were fabricated on buses, contributing to transit operators spending more than one-half of the operating expenses on this way. In contrast, operators spent about ane-tertiary of the operating expenses on rail service.

Bulk of Capital Expenditures Are Spent on Rail. In FRY 2018, near one-third of all passenger trips on transit in California were made on rail. Although rail is a less commonly used mode of transit than buses, track typically requires more all-encompassing infrastructure and equipment to operate. As such, track projects deemed for more 70 percent of transit capital expenditures.

Federal Funds Are Largely Spent on Capital Projects. Operators spend local, state, and federal funds differently depending on funding programme guidelines. For example, federal funding programs for transit generally provide a 90 percent maximum matching share for capital projects and a l percent maximum share for operating expenses. As such, local operators take to cover a greater share of costs if they utilise federal funds for operations than for capital projects. Because upper-case letter projects tend to be more expensive than operations, transit operators typically utilize federal funds for upper-case letter projects. Consequently, federal funds provide 35 pct of full uppercase expenditures past California transit agencies and only 11 percent of operations spending. About eighty percent of operations expenditures are supported by fares, fees, and local funds.

(Final updated: January 2020)

Transportation Taxes and Fees

What Taxes Apply to Gasoline in California?

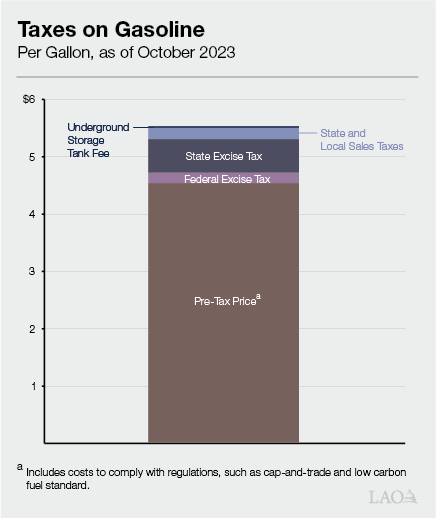

Several Unlike Taxes Impact Gasoline Prices. Many people refer to "the gas revenue enhancement" when talking nigh transportation taxes and fees. Typically, people hateful the state excise tax on gasoline because this is the primary source of land funding for highways and roads. Withal, federal excise taxes and state and local sales taxes as well utilise to gasoline in California. (Various land, federal, and local taxes are also placed on diesel fuel.) The figure beneath shows how much a commuter pays for each taxation when purchasing a gallon of gasoline costing $iv.64 (the boilerplate gasoline toll in California at the fourth dimension this assay was prepared). In this example, the taxes brand up well-nigh 20 percent of the price, with the land excise tax accounting for over one-half of all the taxes paid.

As shown in the figure, the specific taxes on gasoline include:

-

State Excise Tax (51.ane Cents Per Gallon). The land charges this tax to gasoline suppliers before they evangelize gasoline to retail stations. However, research indicates that most, if not all, of the tax is passed along to drivers through higher prices at the pump. Considering the revenue enhancement is set per gallon, the corporeality of tax paid depends just on the number of gallons of gasoline a commuter purchases, irrespective of the toll of each gallon. The land excise tax is adjusted each July for inflation.

-

Federal Excise Revenue enhancement (18.iv Cents Per Gallon). In addition to the state excise tax, California drivers pay a federal excise tax on gasoline. This tax works similarly to the state excise tax—that is, the tax is not paid directly by drivers though it does increase gasoline prices they pay at the pump. The federal excise tax is not adjusted annually for inflation.

-

Land and Local Sales Revenue enhancement (three.7 Percent, on Average). Sales taxes are set equally a percentage of the price of gasoline. Unlike excise taxes, drivers are charged these taxes straight at the pump, although gasoline stations include the tax in the prices they advertise. The current average state and local sales tax rate on gasoline is 3.7 percent, though the rate can vary from every bit depression as 2.25 percent to as loftier equally five.75 percent depending on the locality. (The sales tax on gasoline in California is notably lower than the sales tax on most other goods—which averages viii.7 percent—mainly considering gasoline is exempt from the portions of the sales tax that back up the state General Fund and 2011 Realignment.)

Storage Fees and Other Land Policies and Programs Also Affect Gasoline Prices. In addition to the taxes described higher up, the state levies a fee of 2 cents per gallon on owners of hush-hush storage tanks that contain petroleum. The land also has other programs and regulations that touch gasoline prices. For instance, the state's cap-and-trade program affects gasoline prices considering it requires fuel suppliers to purchase permits that comprehend the greenhouse gases emitted when the fuel is burned. Nosotros estimate that this currently adds 23 cents per gallon to the price of gasoline. The country also has a low carbon fuel standard plan that requires suppliers of high carbon fuels (such as gasoline) to purchase credits from suppliers of depression carbon fuels (such equally renewable diesel). We guess that this currently adds xviii cents per gallon to gasoline prices.

(Terminal updated: December 2021)

How Does the State Spend Gasoline Tax Revenues?

State Excise Tax Pays for Highways and Roads. In 2021‑22, the country gasoline excise tax is set at 51.ane cents per gallon, and the tax is expected to enhance $6.8 billion from gasoline purchases for vehicles using public roads. In issue, the 51.1 cent tax is comprised of three distinct components, each of which is adapted for inflation in July and allocated based on formulas set along in country law. The figure below shows a simplified version of how of each of these taxes are allocated to major transportation accounts and programs.

As shown in the figure, the state excise tax on gasoline consists of the following:

-

Base Revenue enhancement. In 2021‑22, this part of the excise tax equals nineteen.iv cents per gallon and is expected to enhance $2.6 billion. 2-thirds of these revenues are deposited into the Pike Account to pay for state highway maintenance, rehabilitation, and related administration. The remaining 1-third of the revenues are provided to cities and counties to back up their streets and roads.

-

Incremental Revenue enhancement. In 2021‑22, this role of the excise tax (formerly referred to equally the "bandy revenue enhancement") equals 18.7 cents per gallon and is expected to raise $ii.5 billion. Commencement call on these revenues is to "backfill" the Land Highway Account for truck weight fee revenues that have been redirected in contempo years from the Throughway Business relationship to instead pay for transportation bail debt service. In 2021‑22, this corporeality equals $one.3 billion and is available for highway maintenance, rehabilitation, and related administration. The remaining revenues are allocated as follows: (1) 44 percentage to cities and counties for their streets and roads; (ii) 44 percent to the State Highway Business relationship for the State Transportation Comeback Program, which mainly funds highway and roadway chapters expansions; and (3) 12 percentage to the Motorway Account for the Freeway Operation and Protection Plan, which mainly funds state highway rehabilitation projects.

-

Senate Bill one Tax. In 2021‑22, this part of the excise tax equals xiii cents per gallon and is expected to enhance $1.7 billion. (Senate Pecker [SB] 1 is discussed in more detail after in this postal service.) All of the associated revenues are deposited into the Route Maintenance and Rehabilitation Business relationship (RMRA)—in addition to the other revenue enhancement and fee increases from SB 1. In RMRA, $762 million is set aside annually to fund specified transportation programs, such as agile transportation, bridge and culvert repairs, and transportation enquiry. We judge that roughly $400 million of the SB i gasoline excise tax revenues are used for such programs. Of the remaining $i.3 billion, half stays within RMRA to fund state highway maintenance and rehabilitation, while the other half is provided to cities and counties for their streets and roads.

Land Excise Taxation Also Pays for a Few Other Programs and Costs. Not counted above or shown in the figure is an additional $390 million in state gasoline excise tax revenues. Almost of these revenues come from gasoline purchases for off-highway vehicles, agricultural vehicles, boats, and aircrafts. The country does not spend these funds on highways and road programs since these vehicles do not use this infrastructure. Instead, the country dedicates these revenues to the General Fund, land parks (for general park purposes, off-highway vehicle programs, and boating programs), agricultural programs, and helmsmanship programs. In addition, a small portion of land gasoline excise tax revenues pay for the costs associated with collecting and distributing the revenues.

Federal Excise Revenue enhancement Pays for Highways and Transit. The federal regime dedicates about 85 percentage of federal gasoline excise revenue enhancement revenues to highways, with the remainder primarily supporting transit. The federal government distributes the associated revenues to states through diverse highway and transit grant programs.

Country and Local Sales Taxes Pay for Various Local Programs. Revenues from sales taxes on gasoline are allocated in the same manner as revenues from sales taxes applied to most other appurtenances (except gasoline is exempt from certain portions of the sales revenue enhancement). These revenues pay for various city and canton programs, including transportation programs.

(Concluding updated: December 2021)

How Have Gasoline Taxes Inverse Over Fourth dimension?

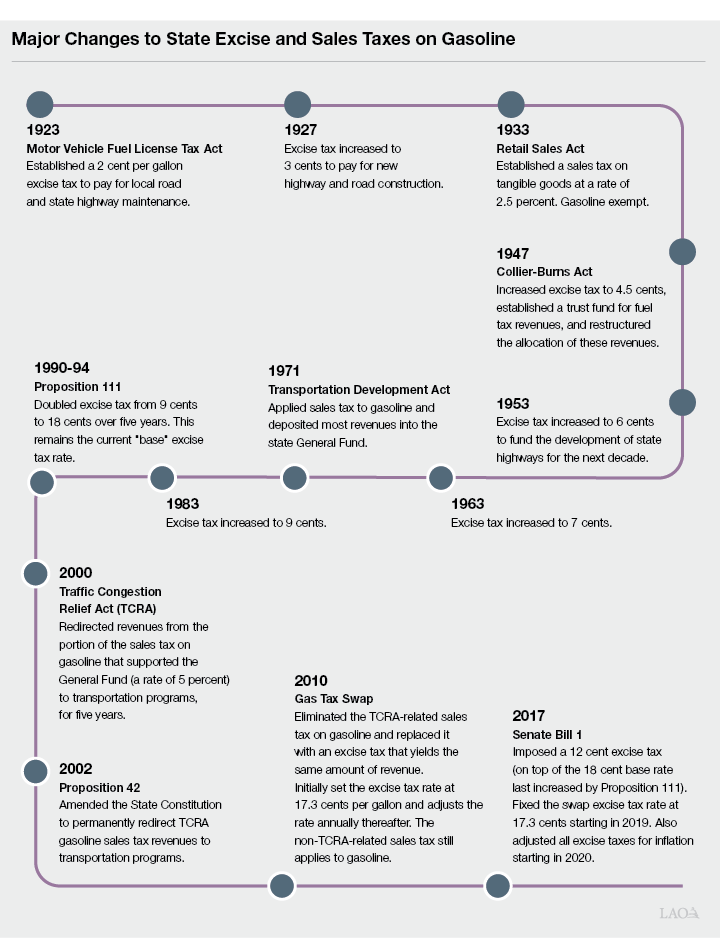

State Excise Tax and Sales Taxes. The state excise taxation and sales taxes on gasoline have a continued history. The figure below shows the major changes to these taxes over roughly the past 100 years.

Below, we summarize how certain gasoline taxes have changed over time.

-

Base Excise Tax. In 1923, the state created a 2 cent per gallon excise tax to pay for road and highway maintenance. It then increased the rate periodically over the next several decades to increase funding for roads and highways. Most recently, in 1990, voters passed Proposition 111, which doubled the rate from 9 cents per gallon to 18 cents per gallon.

-

Swap Excise Tax and Sales Taxes. In 1933, the state established a sales taxation on tangible appurtenances, but exempted gasoline. In 1971, the state extended the sales tax to gasoline, with most of the associated revenues going to the state General Fund. In 2000, the state began redirecting gasoline sales tax revenues from the General Fund to pay for various transportation programs. Then, in 2010, the land enacted a tax "swap" in order to have more flexibility over how it could spend these revenues. Specifically, the state eliminated the portion of the sales tax on gasoline that had been redirected from the Full general Fund to transportation programs (a five pct sales tax rate) and replaced it with an equivalent cost-based excise revenue enhancement, which became known equally the swap excise taxation. Each year, the land would adjust the swap excise taxation rate based on the projected cost of gasoline to raise an equivalent amount of revenue as would have been raised past the 5 percent sales revenue enhancement information technology eliminated. The portion of the state sales tax that historically did not go to the General Fund (currently 2.25 percent statewide) still applies to gasoline.

-

Senate Beak 1 Taxation. In 2017, the Legislature enacted Chapter 5 (SB i, Beall), which augmented funding for the country'southward transportation organization. Among other changes, the legislation increased the excise revenue enhancement on gasoline by 12 cents per gallon, which went into consequence on Nov 1, 2017. In addition, the swap excise tax—now called the incremental revenue enhancement—was modified from beingness administratively determined to beingness set at 17.3 cents per gallon on July 1, 2019. The legislation also established annual inflation adjustments to each of the iii components of the excise tax on gasoline beginning in 2020.

Federal Excise Tax. In 1932, the federal government imposed a 1 cent per gallon excise taxation on gasoline to help reduce the federal deficit. Information technology subsequently increased the rate by another cent during the 1940s and 1950s to help pay for Earth War II and the Korean War. In 1956, the federal regime increased the rate to three cents and dedicated all the revenues to the construction of the interstate highway organisation. The adjacent major change occurred in 1983, when the federal government increased the rate to nine cents and began to apply a portion of gasoline excise tax revenues for transit programs. In the early 1990s, the federal regime again increased the rate on 2 occasions to help reduce the federal deficit, though inside a few years information technology had redirected all the revenues back to highway and transit programs. In the decades since, the federal excise tax rate has remained at 18.4 cents.

(Last updated: December 2020)

Source: https://lao.ca.gov/Transportation/FAQs#:~:text=The%20federal%20government%20dedicates%20about,highway%20and%20transit%20grant%20programs.

Posted by: gibsonbronge38.blogspot.com

0 Response to "Is Gas Tax Money Going Toeards Transit Projects"

Post a Comment